Saudi Arabia is becoming a key player in the world of critical minerals. As the shift towards clean energy, electric vehicles, and advanced technology accelerates, the demand for vital minerals like lithium, cobalt, nickel, and rare earth elements is on the rise.

For Saudi Arabia, this isn’t just about mining; it’s a strategic move to diversify the economy and enhance its global standing.

Vision 2030: A Bright Future with Critical Minerals

Under its Vision 2030 plan, Saudi Arabia aims to reduce reliance on oil, expand income streams, and build advanced industries. The mining sector, previously overshadowed by oil, is now a central focus.

The Kingdom has access to an estimated $2.5 trillion in untapped mineral resources, crucial for clean energy technologies and beyond. By investing in domestic mining and processing, Saudi Arabia can turn raw materials into valuable products and boost its economy.

Economic Impact: $75 Billion by 2030

One of the most exciting projections for the Kingdom is economic growth. Expanding the mining sector could add nearly $75 billion to Saudi Arabia’s GDP by 2030, an impressive increase from current figures.

The real opportunity lies in processing these minerals. Saudi Arabia has the engineering capabilities, low energy costs, and investment potential to build essential facilities.

This growth can lead to advanced industries such as:

– Manufacturing of permanent magnets

– Production of advanced electronics and semiconductors

– Development of electric vehicle (EV) components

– Creation of energy storage systems

These sectors complement the goals of Vision 2030 by creating a diverse and valuable industrial ecosystem.

Driving the Energy Transition

Saudi Arabia is also committed to a domestic energy transition, aiming for 130 GW of installed power capacity by 2030, with half coming from renewable sources. Critical minerals play a vital role in this transition, supporting renewable technologies like solar and wind.

By utilizing more sustainable energy, Saudi Arabia can reserve more oil for profitable petrochemical production.

Building a Digital Future

The Kingdom is not just focusing on energy; it’s also investing in digital infrastructure. The Public Investment Fund (PIF) has designated $6 billion for a major data center ecosystem. Saudi Arabia’s advantages, such as low-cost renewable energy and extensive data connectivity, make it an ideal location for digital businesses.

By securing local sources of critical minerals, the Kingdom can enhance its digital capabilities and reduce costs, establishing itself as a central digital hub for the Middle East.

Industry 4.0: The Gulf’s Emerging Competitive Edge

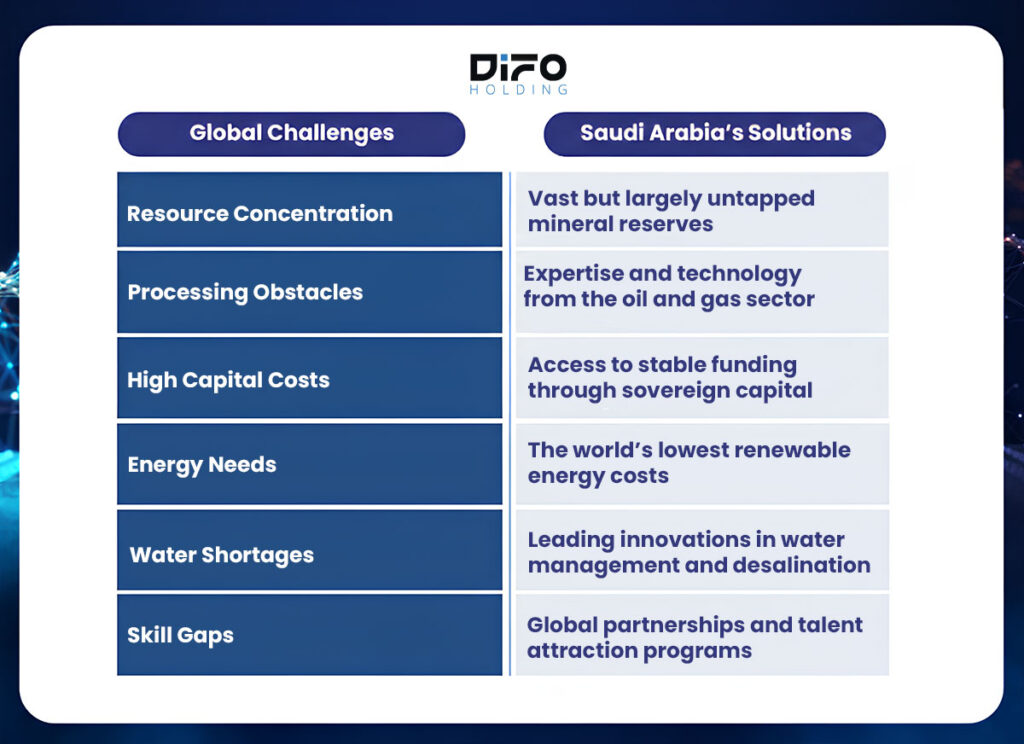

Saudi Arabia is in a strong position to resolve key challenges in the global critical minerals market:

Gulf Collaboration

Although competition with the UAE is a reality, strategic collaboration among Gulf countries could bring even greater advantages. Developing a Gulf-wide cluster that integrates mining, processing, logistics, and green metals hubs would reduce inefficiencies while attracting hyperscalers and enhance pricing power across the region.

Collaborative moves, such as mineral innovation parks, green metal hubs, and unified pricing frameworks, have the potential to position the Gulf Cooperation Council (GCC) as a formidable counterpart to established global leaders. This initiative would also support critical infrastructure projects like the International Multimodal Economic Corridor (IMEC), which aims to integrate clean energy, data centers, and resilient supply chains.

Conclusion: Transitioning from Oil Dominance to Mineral Leadership

Saudi Arabia’s critical minerals strategy is a core part of its economic and geopolitical shift. By using its vast resources, financial strength, industrial know-how, and strategic location, the Kingdom has a credible path to unlocking $75 billion in new economic value while shaping the future framework of the global energy transition.

If pursued responsibly and collaboratively, Saudi Arabia’s ascent as a leading critical minerals hub could revolutionize global supply chains and solidify its influence long after the oil age comes to an end.