Saudi Arabia is undergoing a monumental transformation under Vision 2030, with over $1 trillion in infrastructure investment powering nationwide change. One of the most profound outcomes is real estate development, projected to grow by nearly 30% by 2025.

For developers, asset managers, and regional firms invested in long-term value creation, this is a time of unprecedented opportunity.

The Power Behind the $1 Trillion Infrastructure Investment

Massive infrastructure projects such as NEOM, Red Sea Global, Jeddah Central, and Rua Al Madinah are setting the tone for a new urban era.

Spanning mobility, tourism, and energy ecosystems, these developments are not only physical undertakings but engines for economic diversification.

By late 2024, the Kingdom had allocated more than $1.3 trillion toward projects that will deliver over one million new housing units and introduce world-class commercial and hospitality real estate.

How Infrastructure Investment Translates to Real Estate Growth

New Cities & Strategic Districts

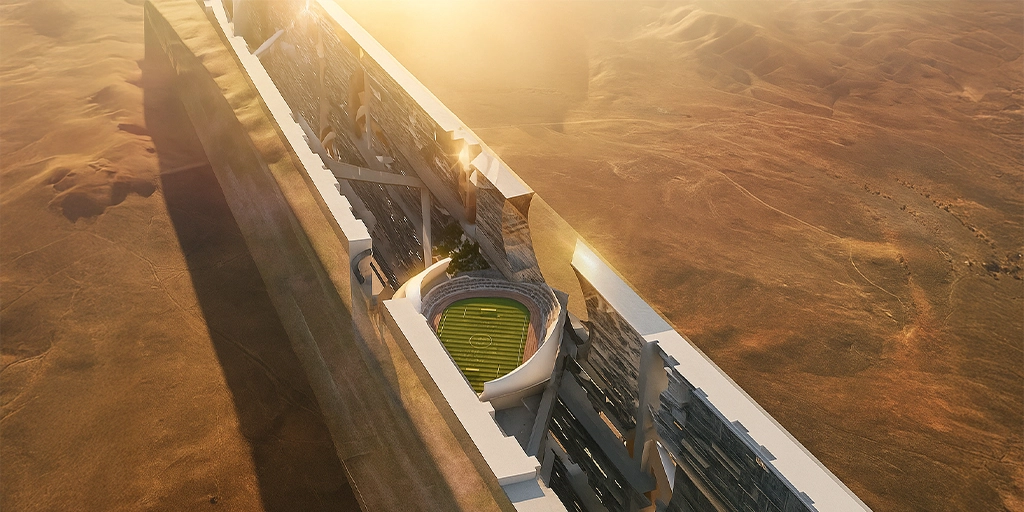

Emerging hubs like The Line in NEOM or the reimagined waterfront of Jeddah Central are creating entirely new real estate landscapes.

These zones promise connectivity, smart urban planning, and high livability standards that are attracting both residents and global investors.

ESG-Led Growth

Sustainability is now at the core of Saudi real estate.

From energy-efficient buildings to integrated public transport, the ESG layer is reshaping design, development, and financing. Projects that meet international green standards enjoy broader access to institutional capital and align with Saudi Arabia’s long-term resilience strategy.

Real Estate Market Outlook to 2025

With a 30% expansion forecast, the sector is seeing substantial gains in residential, commercial, and mixed-use projects.

Real estate transaction volumes in key cities like Riyadh and Jeddah have steadily risen, while demand for logistics, hospitality, and branded residential units is outperforming pre-2020 benchmarks.

This growth is expected to continue as infrastructure completion accelerates over the next 18 months.

Strategic Considerations for Regional Developers

Companies involved in urban development and property asset management, particularly those with a long-term outlook, are well-positioned to capitalize on Saudi Arabia’s real estate evolution.

Success hinges on aligning with national infrastructure timelines, integrating ESG-compliant design, and adopting strategic land banking and mixed-use development approaches.

Developers who anticipate zoning shifts, regulatory changes, and population migration patterns will be best equipped to create resilient, future-ready portfolios.

Project Highlights: Reshaping the Landscape

NEOM

Set to cover 26,500 km², NEOM is a cross-border city of the future. Its modular design, anchored by The Line, represents a paradigm shift in vertical urban planning.

Red Sea Project

Focused on luxury tourism, this project includes 50 hotels, over 8,000 rooms, and multiple resort‑based residential districts, all tied to sustainability goals and global hospitality standards.

Jeddah Central & Rua Al Madinah

Revitalization efforts in these heritage-rich areas are yielding tens of thousands of housing units and major cultural assets. Both developments contribute directly to livability, tourism, and economic inclusion.

Managing Risk in a Rapidly Evolving Market

While the opportunity is substantial, the market also faces constraints. These include fiscal tightening as Saudi Arabia balances its budget, potential delays in project delivery, and global economic pressures.

Staying agile, through smart partnerships, land strategies, and sustainable design, will be essential.

Conclusion

Saudi Arabia’s infrastructure expansion under Vision 2030 is redefining the future of real estate across the region. With projections of 30% growth by 2025, the landscape is dynamic and opportunity-rich.

Firms aligned with the transformation, through sustainable investments, land development, and urban planning, stand to benefit not just in the short term, but as contributors to the Kingdom’s long-term economic rebalancing.